Atualizado por último em 3 dias por Agência Nex Step

Insurers calculate annuity payouts partially by estimating how long they anticipate to make payments. This is based on your age and sex, which affect your projected life expectancy. And, remember to contemplate the issuer’s financial energy and the contract terms carefully. Scores from companies like AM Finest may give you insight into the insurer’s capacity to fulfill its obligations over time.

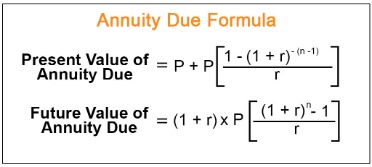

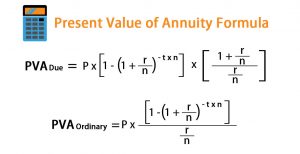

Working with a fee-based monetary advisor rather than one compensated by annuity commissions also can help ensure you’re selecting a product that genuinely aligns together with your https://www.personal-accounting.org/ needs. This article explores the key variations between annuities and perpetuities, outlining how each provides revenue over time and when each could also be suitable for retirement or legacy planning. It just isn’t meant to offer, and should not be interpreted as, individualized investment, authorized, or tax recommendation. For advice concerning your own scenario please contact the suitable professional. The GainbridgeⓇ digital platform supplies informational and academic sources intended only for self-directed purposes. This article shows you tips on how to use an annuity desk to calculate the present worth (PV) or future worth (FV) of your annuity funds.

For immediate annuities, today’s rate of interest directly determines your cost quantity. For deferred annuities, current charges have an effect on the expansion of your premium through the deferral period — so rising rates over time can translate into greater future payouts. However whereas annuities do come with some sizable benefits total, what you stand to realize from an annuity relies upon closely on the type of annuity you choose, particularly right now. From mounted to variable to indexed options, every kind of annuity comes with its own steadiness of risk, reward and complexity. For example, while some annuities promise higher returns, these often include exposure to market downturns or sophisticated fee buildings.

A mounted annuity’s payout is affected by the interest rate, the size of the buildup phase and the annuitant’s life expectancy. Annuity.org rigorously selects partners who share a common objective of teaching shoppers and serving to them select the most acceptable product for his or her distinctive financial and life-style goals. Our community of advisors won’t ever recommend products that are not proper for the patron, nor will Annuity.org. Additionally, Annuity.org operates independently of its companions and has complete editorial management over the information we publish. JPMorgan Chase and its affiliates don’t present tax, legal or accounting recommendation. This materials has been prepared for informational functions only, and is not intended to offer, and should not be relied on for tax, legal or accounting recommendation.

Fastened Annuity Calculator

Our month-to-month annuity calculator might help you make informed choices about your financial future by offering accurate and personalized results to information your retirement planning. Our licensed annuity brokers do that be good for you — scanning payouts across greater than 50 insurers to make sure you lock within the highest assured revenue available at present. With Out this comparison, you risk leaving tens of thousands of dollars of retirement income on the table.

Enter your age, state, and premium quantity, then select whenever you need earnings to start. The calculator immediately shows your annual and month-to-month payouts, ranked from the highest-paying insurers to the bottom. Although a set annuity calculator could be a priceless tool in understanding how these annuities work, there are some limitations to contemplate when using it. We are compensated when we produce legitimate inquiries, and that compensation helps make Annuity.org a fair stronger resource for our viewers. We may, at occasions, sell lead information to partners in our network in order to finest join consumers to the knowledge they request.

Roll over your 401(k) from your earlier employer and compare the benefits of Basic Investment, Conventional IRA and Roth IRA accounts to decide which is best for you. Choosing how your earnings annuity pays out is about more than numbers—it can also be about balancing today’s needs with tomorrow’s security. By understanding how life expectancy, payout guarantees, interest rates and elective options interact, you also can make confident decisions that suit your retirement objectives. Both provide guaranteed, predictable revenue for all times — and with this calculator, you possibly can simply estimate your payments beneath each scenario to find the right fit in your retirement targets. Your income annuity payout is in the end shaped by who you would possibly be, how lengthy you defer, and the features you select. An immediate annuity converts your savings into immediate earnings, while a deferred annuity lets your cash grow earlier than turning it into future funds.

Working Out Of Cash In Retirement: What’s The Risk?

- This calculation isn’t a tough estimate — it’s a side-by-side comparability of precise annuity contracts out there right now.

- Find out how an annuity can offer you assured month-to-month earnings all through your retirement.

- This type of annuity combines the predictable progress of a tax-deferred MYGA with the security of guaranteed lifetime withdrawals.

- It could be ideal for evaluating investments and retirement distributions or to organize for big future expenses now.

- P. Morgan’s funding enterprise, including our accounts, services and products, as well as our relationship with you, please review our J.P.

- As of October 2025, with a $900,000 annuity, you’ll receive an immediate cost of $5,four hundred per thirty days beginning at age 60, $5,948 per thirty days at age sixty five, or $6,412 per month at age 70.

A $100,000 mounted annuity with a four.5% interest rate and a 10-year maturity interval annuity calculator might pay as a lot as $926.07 per thirty days for a 65-year-old man or $802.59 for a 65-year-old woman. Bank deposit accounts, corresponding to checking and financial savings, may be topic to approval. Deposit merchandise and associated providers are provided by JPMorgan Chase Bank, N.A. Member FDIC.

The preliminary rate of interest of a fixed annuity is usually solely assured for the first year or first few years of the contract. The objective of the fixed annuity calculator is that can assist you estimate how a lot your fastened annuity contract will grow over time. To use this fixed annuity calculator, merely fill out the fields with details about yourself and your fastened annuity. You’ll enter details together with your present age and tax rate as well as the age and tax fee you’ll be at if you intend to begin withdrawing from your annuity. Whether you like to independently handle your retirement planning or work with an advisor to create a personalised strategy, we can help.

Finest Mounted Annuity Charges

As of October 2025, with a $75,000 annuity, you’ll get a direct payment of $450 per month beginning at age 60, $496 per 30 days at age 65, or $534 per 30 days at age 70. As of October 2025, with a $75,000 annuity, you’ll get an immediate cost of $420 per thirty days beginning at age 60, $466 per month at age 65, or $508 per month at age 70. As of October 2025, with a $75,000 annuity, you’ll get a direct fee of $360 per thirty days beginning at age 60, $400 per 30 days at age 65, or $430 per thirty days at age 70.

Readers are by no means obligated to make use of our partners’ providers to access the free assets on Annuity.org. Annuity.org is a licensed insurance coverage company in a quantity of states, and we’ve two licensed insurance coverage agents on our employees. However, we do not sell annuities or any insurance products, nor do we obtain compensation for promoting specific products. As An Alternative, we companion with trusted professionals within the annuity industry.